Testimonials | Nikhil Singhi Financial Services | NSFS | 2021

Take a look at the testimonials of successful business owners who are a part of the #NSFSTribe Videos shot at "Financial Forum International - Conclave 2021" [embed]https://www.youtube.com/playlist?list=PLE2jsSdIBxrRM7iHlZukiXPkXYczBX-Q8[/embed]...

Read More

GOLDEN FINANCIAL HABITS -The Art of Documentation

Habits determine our actions and our actions determine our outcomes. It’s as simple as that. Right from the time we wake up to the activities that we perform to the time we sleep, everything is carried out in a more or less pattered format. This pattern ultimately results in the formation of habits. “Our habits are majorly driven by our subconscious mind and it is believed that around 45%-9...

Read More

GOLDEN FINANCIAL HABITS – REVIEWING RECORDS

“The key learning and ultimately growth of an individual is through analysis or review of activities already undertaken, a practise of significance followed religiously by a majority of successful people”. (P.C: Google Images) It is this practise that can create an impacting difference in one’s overall finances too. Accumulating data, record keeping is done by a majority chunk of people g...

Read More

GOLDEN FINANCIAL HABITS – PURPOSE-BASED BUDGETING

“The two most important days in your life are the day you are born and the day you find out why.” -Mark Twain. (P.C: Google Images) Connecting life with a purpose is what usually drives one towards excellence and better well-being. Translation of that purpose into clear action plans and adherence to those action plans is what makes a difference, creates greater impact and makes an individua...

Read More

GOLDEN FINANCIAL HABITS – PRIORITIZATION

Each of us has many pending or to-do list and at some point we all feel overwhelmed by looking at the tasks yet to be completed. This is solely because a majority of us don’t know how to and what to prioritize. Prioritization plays a significant role in polishing one’s skills and results in better productivity. It is often seen that we tend to maximise our results when we have a specific ...

Read More

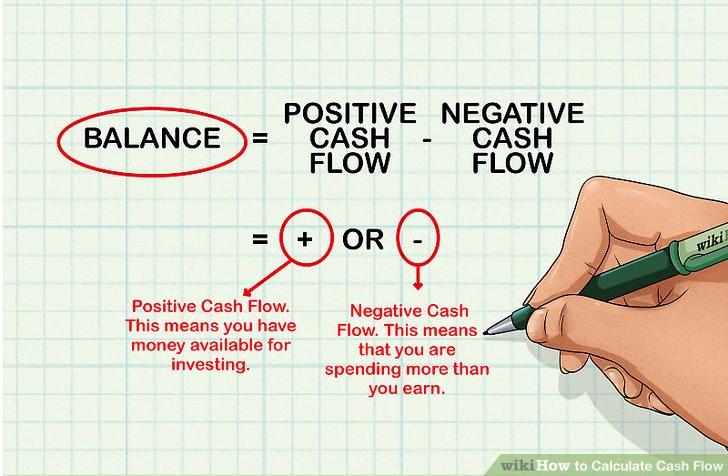

GOLDEN FINANCIAL HABITS – CASH FLOW STATEMENT

A cash flow statement is simply a financial record of all your inflows and outflows of cash. Maintaining a healthy cash flow statement is critical to one’s overall finances. “Your cash flow statement is an indicator of whether you’re in the right path towards building your overall net worth or overall finances. One of the golden rules of wealth creation is to spend lesser than what one ea...

Read More

Live Chennai Interview of Nikhil Singhi, a Financial Service Specialist

Here in the special interview of Nikhil Singhi for Live Chennai YouTube channel the loan management queries are answered in a simple and strategical tone. Nikhil Singhi is a specialist working in varied niches concerned with financial services. He gives a clear notion of managing loans and recognizing the importance of analyzing ways to payback all the debts in term of interest and time period....

Read More

WAYS TO MAKE MONEY OFF YOUR ASSETS

How well do you know your assets? How often do you talk about money with your assets? What kind of relationship do you share with your assets? How often your assets work back for you? The above questions may seem odd to a common eye but when looked from the perspective of finance, the answers to the same questions would be significant in increasing your pace towards attainment of ultimate finan...

Read More

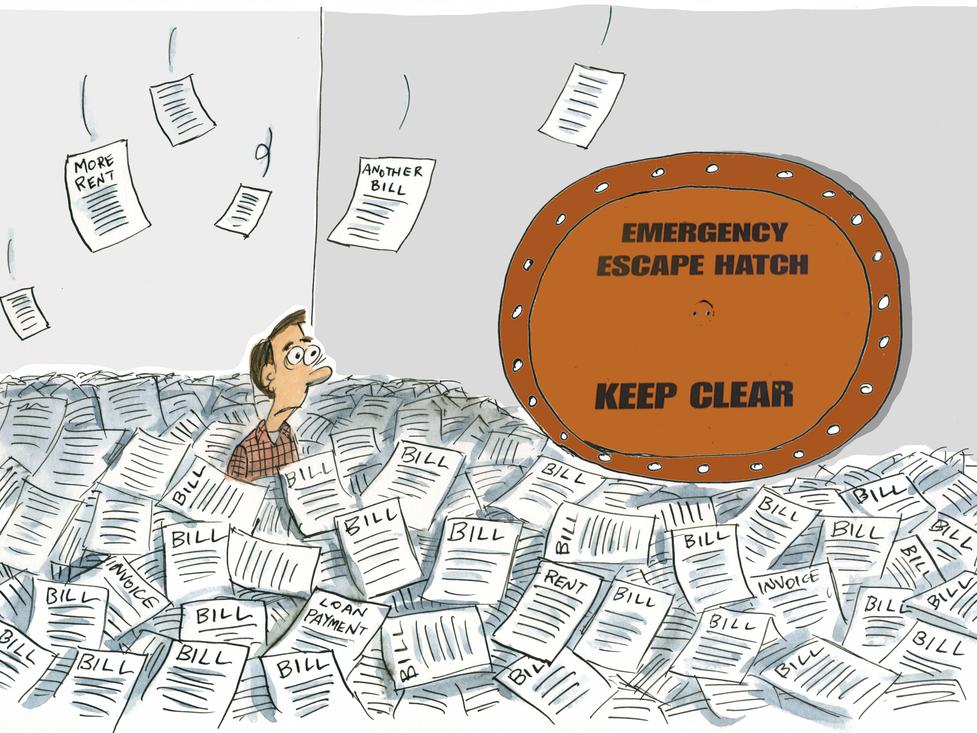

RAISING LOANS TO OVERCOME A DEBT TRAP?

Are you facing a debt-like situation? Are you in a debt? How deep are you in the debt pit? These questions are important to analyse periodically as debt acts like a leaked tap in your financial tank. You may not even realise that you’re in a debt trap until the situation becomes severe and the effects of it are displayed clearly. Most people generally evaluate their level of debt based on the...

Read More

ONE WAY TO HEDGE BUSINESS RISK

Are you aware of the many risks surrounding you!? Are you aware of what impacts these risks can have to you, to your family and to your organisation!? How often do we account for such risks while taking decisions, small and big alike? Have you calculated your human life value? A business owner is well aware of the many risks surrounding him and his organisation such as key person leaving the co...

Read More

WANT TO KNOW WHERE THE MONEY IS?

Our lives are like a slate. Just like how we write with a chalk on a slate and erase it when we want to write something else on it, similarly as humans we list down a set of targets or goals to achieve and keep working on them. However, it’s generally noted that we tend to lose our patience after some time and a majority of us even move on to the next task without completing the previous task...

Read More

FIRST RULE TO OVERCOME A DEBT TRAP

Money has become an integral part of our lives. We dedicate maximum amount of our time towards doing things that’ll help us generate money. While do this however we fail to check on the leakage; ie: the outflow of money. Failure to maintain a balance between the two opens the doors to debt. (P.C: Pexels.com) Debt is a state of mind first. The first rule to overcome a debt trap is to find out ...

Read More

ROMANCING WITH MONEY

(P.C: Google Images) Money for ages has been looked as a materialistic pursuit of people. This perception has influenced the manner in which a majority people think about it and behave with it accordingly. A conflicting relationship where money is mostly viewed as “something to conquer as it’s hard to earn” has affected the relationship people share with money. P.C: Google Images) Instead...

Read More

LEGAL RISK IMPACTING YOUR FINANCES

The society around us is governed by law and order. There are certain rules and regulations with which we govern our lives as well. These laws play an important role in protecting us from any legal action that has the potential to drain a significant amount from our finances. Before engaging in taking any sensitive decision if a legal document is not provided for the same, then it’s our respo...

Read More

INTEGRATIVE THINKING TO OVERCOME DEBT TRAPS

Problems and solutions are part of our everyday lives. We are either busy solving our problems or someone else’s problems or sometimes we are just busy creating one for ourselves even though there’s isn’t any problem. These problems can range from emotional to mental or even financial problems. Without being aware, we’ve also set a pattern to approaching a said problem and seeking solu...

Read More

COUNTERING FINANCIAL IMPACT OF HEALTH RISK

“THE FIRST WEALTH IS HEALTH” – Ralph Waldo Emerson. The key to a strong financial life is a person’s good health. The logic is simple: only when your health is intact would you be able to focus on other important things in your life otherwise all the hard work done towards building that financial corpus would go into paying various medical expenditures! (P.C: Google Images) It’s stran...

Read More

GOLDEN FINANCIAL HABITS – MONEY HAS TIME VALUE

“Every rupee that you own has a time value attached to it.” (PC: Google Images) This is one of the core principles of finance. It simply means that every rupee you own today has far greater value or worth than a rupee owned tomorrow. The logic being that a rupee today can be leveraged to generate more money in the future as money has time value. In a world dominated by consumerism, money ha...

Read More

SECOND WAY TO HEDGE BUSINESS RISK

“How often your business does get impacted because of delayed payments? How often do you face difficulty in collecting payments from the other parties?” I’m sure, as business owners, you must have and you must be facing these situations on a frequent basis. Trouble with your payment collection or delay in it directly impacts your current financial health while affecting your future financ...

Read More

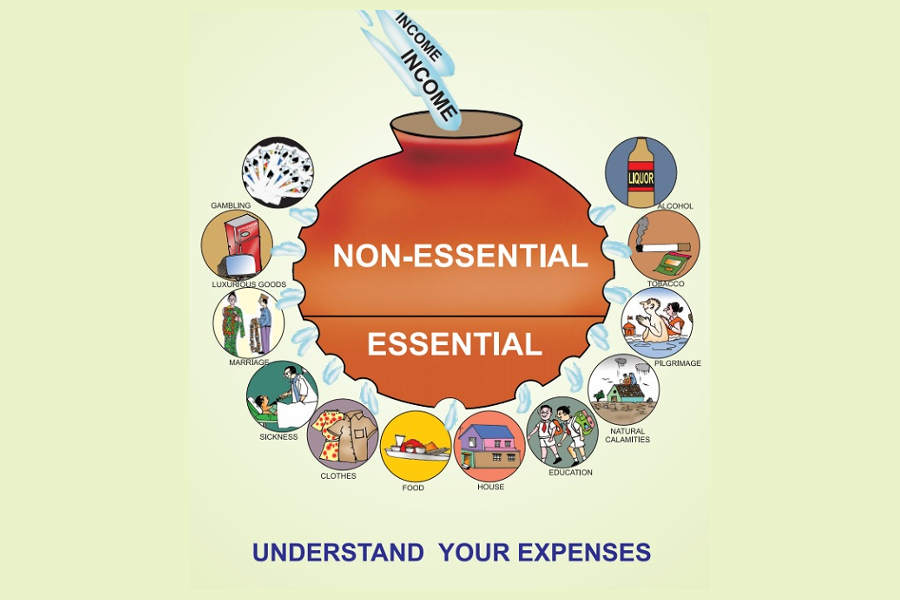

BUDGET YOUR WAY OUT OF DEBT

Budget and debt are two of the most common words in a financial dictionary. Many know the importance of budgeting and managing debts but very few actually put it to practise. In fact one of the simplest ways of overcoming a debt trap and ensuring long-term sustainability of cash inflow is to practise budgeting. During our younger days, we generally executed our expenditures carefully so that w...

Read More

COMMON FINANCIAL MISTAKES

Handling money is a tricky subject. It’s an important skill to learn especially when you’ve just started earning. You may think that you are doing the right thing by making that investment into land but then you don’t have sufficient liquid cash in hand to meet daily expenses…You may think that buying a new car on EMI is a smart purchase but you fail to realise that if doesn’t suit your ...

Read More

WHO AFTER YOU?

“WHO AFTER YOU?!” This may seem as an absurd question to many. Why would I invest my time wondering about my death and decide on who will get what of which I own currently? Isn’t life all about living in the present? True but you must know that you as an individual aren’t just responsible for yourself, you are responsible to your loved ones as well. You need to figure out and frame your wi...

Read More

CHIT FUND: A GOOD WAY TO STASH AWAY YOUR CASH?

The concept of chit fund is ancient to India and over the years it has become a popular tool, especially for business owners and traders. It’s a platform that brings together savers and borrowers who commit to contribute or invest a fixed monthly sum for a fixed period of time. The subscribers generally see this scheme as a win-win and the reason for its popularity is: Convenie...

Read More

AND IT HAPPENED AGAIN…EVERYDAY FINANCIAL STRUGGLES!

In our short life, we often commit actions without any concrete reason or purpose. Most of the times, emotions have a major role to play because when asked "Why did you do it?” the person replies, “Just like that. I felt like doing it.” Sounds familiar? I’m sure it must. The same attitude or rather approach is true when it comes to our financial transactions as well. You may be surprised...

Read More

Know how your Car Emi vrooms with your Monies

I’m sure most of us if given an option would like to purchase a high end car having speed equivalent to that of a plane (sure, why not!) and one with the best of facilities, may be a Tesla or a Porsche or maybe even a Bugatti Veyron would satiate our desires. Well, all those who think this are wrong. Humans are programmed in such a manner that when one desire is satiated, two others pop up and i...

Read More

When emotions Hijack your Finances

Ever wondered why is it that even though you’ve fulfilled your near and dear one’s wishes by incurring an expenditure, which you’d have preferred not to at the present moment owing to the current financial health, you tend to feel not only happy but also regret and guilt? Have you ever given in to emotions and taken decisions, which cause financial stress to you, only to impress people aroun...

Read More

The Swipe Rush-Dawn of Credit Cards

Credit cards, credit cards, credit cards…what thou doeth to me! I swipe and swipe and swipe while thou mount my debt; slowly and oh so clandestinely. I pay tribute to thee and place thee above all my liquid monies whilst thou pay tribute to my enemy (debt) and overwhelm me in its avalanche. I endure to make thee happy whilst thou leech away all my greens (money). I sing this in melancholy, ...

Read More

EMI: The lord of Debts

Very often we come across products and offers that are too tempting for our pockets. During those times logic usually takes a backseat, at least for few seconds, as desire to own the product seeps in. The question of ‘need’ hardly matters then as ‘want’ takes over our decision making ability. Such a desire for a moment faces a risk of extinction when we face the harsh reality of our financ...

Read More

Plan your Debt

Planning is an essential aspect of one’s life. We set goals and make plans to achieve what we want to on a regular basis. Having a financial plan (budgeting) and financial discipline is equally important to stop oneself from committing a financial self-sabotage. Why engage in budgeting? Budgeting helps one to prioritize one’s expenditure based on one’s financial cons...

Read More

KNOCK YOUR DEBT WITH MINIMALSM

The concept of minimalism is an ancient concept followed by our ancestors. As years passed by, people changed, along with that their lifestyle and their preferences also changed. An increase in lifestyle expenditure was noticed which reached its climax during the 2008 financial crisis. The 2008 crisis among other things, have taught us the importance of debt management Most of us in some way or th...

Read More