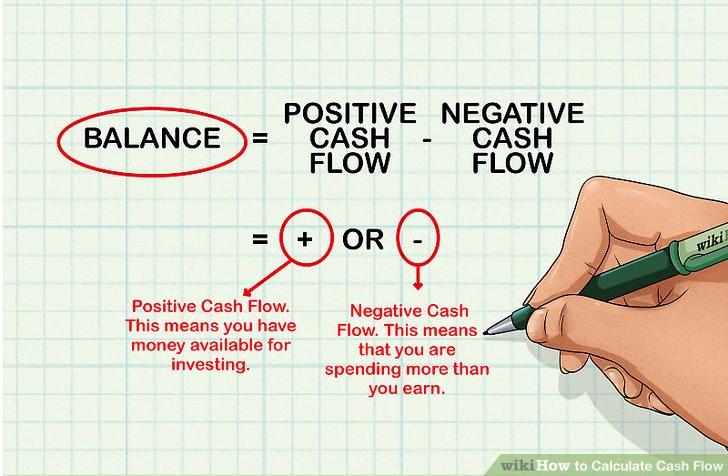

A cash flow statement is simply a financial record of all your inflows and outflows of cash. Maintaining a healthy cash flow statement is critical to one’s overall finances.

“Your cash flow statement is an indicator of whether you’re in the right path towards building your overall net worth or overall finances. One of the golden rules of wealth creation is to spend lesser than what one earns”.

Only by doing the above, one actually begins the process of accumulation of wealth; the rest is secondary including one’s saving amount, setting aside money for investments or for any other purpose. Earning more and spending less can be easily undertaken by looking at alternative options without compromising on the quality, by practicing minimalism, by not undergoing a drastic shift in the lifestyle expenditures with increase in income inflow, by using recyclable goods etc.

(P.C: Google Images)

(P.C: Google Images)

“Cash flow is the lifeblood of business”.

An organization’s long term sustainability or its survival mainly depends on what’s the status of its cash flow. The books may show a different picture altogether; i:e the books may show a favorable picture of the organization doing well while the cash flow statement may narrate a different story altogether. This is one of the significant reasons for businesses to run out of fuel in the long run. It can be concluded that cash flow has the power to not just uplift but take an organization down as well.

(P.C: Pexels.com)

(P.C: Pexels.com)

“A cash flow statement is the backbone of one’s finances. If one doesn’t have knowledge about it, its equivalent to saying that one has incomplete or wrongful knowledge about one’s overall finances; it’s as simple as this”.

This statement helps one to not just become aware but also keep a track on any surplus or deficit of cash flow on a timely basis. Ignorance or neglect towards maintaining it is the first step towards financial mismanagement.

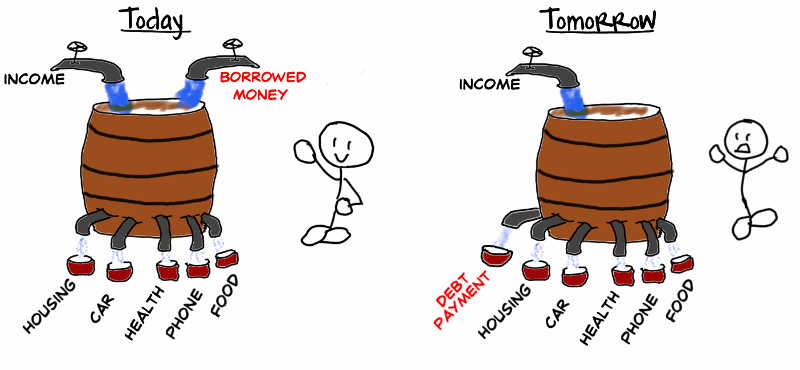

- In case of deficit (amount spent>amount earned or outflow>inflow), most people lookout for other means to raise money to fulfill their needs or desires, often by borrowing.

Borrowing is not an issue of worry here, in fact in the long run what’s more harmful is the mind set or the attitude that kicks in each time when the person is faced with a similar situation. The problem is with the thought process that it’s okay to borrow money when in deficit.

Borrowing is just a temporary solution as money will always demand it value in the future and it will have to be repaid back in the future if not today. Therefore, it can be said that one unnecessarily indulging oneself into a cycle of debt.

(P.C: Google Images)

(P.C: Google Images)

However, being in deficit is also an opportunity to understand what different expenditure pattern one followed on account of which one indulged into overspending.

“Making more money will not solve your problems if cash flow management is your problem”

-Robert Kiyosaki

(P.C: Google Images)

(P.C: Google Images)

- On the other hand, a positive cash flow where the cash inflow exceeds the outflow provides helps in boosting the confidence of an individual. It reflects on approach towards taking financial decisions which is conscious and solid. It also assists one in preparing for long term purpose oriented planned expenditures. One could also leverage the opportunity of deploying the surplus money into an investment or savings instrument that complements with their financial goals.

BENEFITS OF MAINTAINING A CASH FLOW STATEMENT:

- Gives first-hand information of whether in surplus or deficit.

- It helps one to keep a track on source of inflow and the purpose behind the outflow.

- Makes one aware of the gaps in case of deficit between the inflow and outflow of money.

(P.C: Google Images)

(P.C: Google Images)

- Enables one to understand what factors are in their control and what aren’t, thereby helping one to take appropriate steps.

- Helps one to eliminate unwanted or excess expenditure while also helping one to understand returns pattern (inflow) and what can be rearranged or changed to bring a positive shift in inflow of money.

(P.C: Google Images)

(P.C: Google Images)

- By analyzing the statement, an individual in debt can figure out ways to recover a considerable amount of money for debt repayment.

- Provides clarity on way forward; i:e; whether to invest money or to curtail expenditures or to put aside more money for a purpose etc.

- Psychologically one tends to feel safe, motivated and focused towards achieving their ultimate financial vision.

(P.C: Google Images)

(P.C: Google Images)

- Helps in simplifying finance for self and family members, who are now better equipped and better informed to handle finances in your absence. Moreover this practice acts as a catalyst in educating children practically from early on about finance as a subject.

(P.C: Google Images)

(P.C: Google Images)

- Consistent maintenance and reviewing ensures placement of a system to follow at home and at office.

- You’ll be saved from unnecessary financial stress while also being accountable to self, ensuring peace of mind.

WHAT TO DO?

- Note down all sources of income inflow for the month; eg: salary, dividends, pension money, maturity of insurance policies etc;

- Note down all sources of income outflow for the month; eg: house expenditure, business or profession related expenditure, home maintenance etc.

The best way to have a robust cash flow is to continuously and consistently maintain and refer the past and the present statements. This will help to understand inflow and outflow pattern that in turn helps one to establish an estimate for future and be in control of their finances to an extent through proper budget sheet planning.

Therefore, upon maintaining and reviewing a proper cash flow statement, one is structuring and disciplining their approach and actions towards their finances. These are small steps taken today that definitely has the power to impact the finances of tomorrow.

So take charge of your finances and live a stress free life!!

(P.C: Google Images)

(P.C: Google Images)